CREDITS:

By Jeff Ostrowski

Published in the Palm Beach Post | Jan 4, 2019

During Palm Beach County’s real estate recovery, home prices moved in one direction — up, up and up some more.

The robust rebound brought stability back to the housing market, washed away a flood of foreclosures and spurred builders to begin constructing homes. The strong run-up in prices might have run its course, however. While real estate experts expect no crash in Palm Beach County’s property market, they do predict a gradual slowdown in price gains and, for sellers seeking buyers, longer waits.

“Houses will take much longer to sell, but I just don’t see a big downturn in price,” said Ken Johnson, a housing economist at Florida Atlantic University

Real estate analysts point to a variety of reasons for a cooling trend. Millennials, now in their prime buying years, are saddled with hefty student loans and are entering the housing market only haltingly. Mortgage rates rose for much of 2018, dampening demand.

Perhaps most crucially, home price appreciation has outpaced wage gains, pushing many potential buyers out of the market.

“That’s really the crux of the problem,” said David Cobb, regional director at housing research firm Metrostudy. “Prices, combined with the increased mortgage rates, have eroded buyers’ purchasing power.”

Affordability poses a growing challenge. Johnson said Palm Beach County homes now cost 3.7 times annual income, a bit above the 20-year average of 3.1 times income.

In the real estate bubble of 2007, Palm Beach County homes cost 4.7 times income. So while Johnson said home prices have defied gravity in some parts of the country, Palm Beach County is poised for a soft landing rather than a crash.

“Dallas is in a bubble. Denver is in a bubble,” Johnson said. “We’re not. We’re just above the long-term trends. We are overpriced, but only minimally.”

Palm Beach County home prices remain well below their boomtime highs. During the housing bubble, the county’s median resale price peaked at $421,500 in November 2005 (a sum that, adjusted for inflation, equates to $537,622 in today’s dollars). As of November 2018, the median house price was $348,000.

With the economy booming nationally and locally, a downshift in the housing market comes as something of a surprise. After all, a booming labor market and the return of population growth are trends that typically boost property prices.

Palm Beach County’s unemployment rate fell to 3 percent in November, an all-time low. What’s more, people keep moving to Palm Beach County, bringing demand for housing with them. The University of Florida’s Bureau of Economic and Business Research predicts Palm Beach County’s population will expand from 1.41 million in 2017 to 1.64 million in 2030, a 16 percent increase.

Meanwhile, on the supply side of the housing equation, builders took a 10-year hiatus after the Great Recession, capping the number of homes for sale. And large investors such as Invitation Homes snapped up hundreds of houses in Palm Beach County and turned them into rental properties.

Those trends have combined to boost demand, limit supply and put a floor under home prices.

So far, signs of cooling have been faint. In November, there was a 5.1-month supply of houses for sale in Palm Beach County, up ever so slightly from a 4.9-month supply a year earlier, according to the Realtors of the Palm Beaches and Greater Fort Lauderdale. And the number of sales fell only slightly.

However, the median home price rose to $348,000, up 5.5 percent from November 2017. And the median time for a house to sell dipped to 92 days, down from 101 days a year earlier.

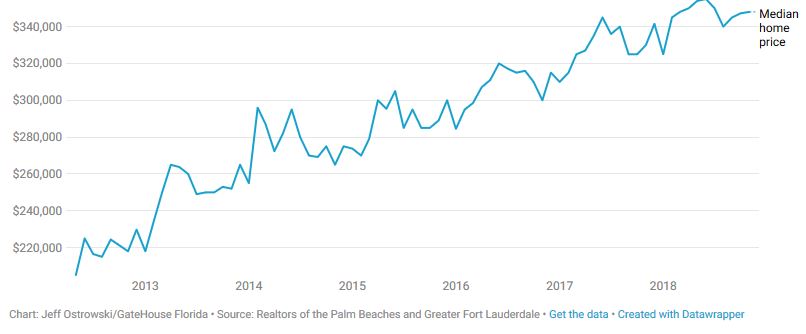

An upward trend

Since 2012, median house prices in Palm Beach County have marched upward.

The mixed messages leave some real estate professionals scratching their heads.

“It’s hard to decipher,” said Jackie Ellis, a Keller Williams broker in Boynton Beach. “Clearly, the market could go either way.”

Like Johnson, she expects any cooling in property prices to be modest, particularly in contrast to the real estate bust that lasted for years and slashed Palm Beach County home values in half.

“I do sense we’re going to get a slowdown,” Ellis said. “But it’s not going to be anything like before, where people had to give back their houses.”

As large-scale home building returns to the county, buyers have begun moving into new houses in the Westlake and Arden developments in western Palm Beach County, and a number of smaller projects are under way.

Builders have been seeking aggressive prices for new houses. In the third quarter, the average asking price of a new house in Palm Beach County was $760,000, Cobb said. However, cooling demand could force builders to offer incentives and cut prices.

“Builders are having to do two things: They’re getting more realistic about their prices, and they’re building a little bit smaller houses to get those prices down,” Cobb said.